Why Python-Based Algos Beat Emotional Trading

Meta Description: Discover how Python-powered algorithmic trading outperforms emotion-driven strategies, offering consistent, data-backed results.

Introduction

Markets are driven by data, but humans are driven by emotion. Fear, greed, and hesitation often cloud judgment, leading to inconsistent results. In contrast, Python-based algorithmic trading systems follow logic, not feelings. That’s why more individual investors are turning to automated solutions like those offered by KiwiFX Innovations.

The Emotional Pitfalls of Manual Trading

Manual trading may feel empowering, but it's filled with psychological traps:

- Overtrading after a big win

- Hesitating to cut losses

- Revenge trading after a bad trade

- Confirmation bias while reading market data

Even experienced traders fall into these traps. Emotional decisions lead to unpredictable results and higher drawdowns.

Why Python Is Ideal for Algorithmic Trading

Python is the top choice for building trading algorithms. Here’s why:

- Clear syntax and flexibility

- Massive ecosystem (NumPy, Pandas, TA-Lib, Backtrader)

- Easy API integration with brokers

- Scalability for testing and deploying complex strategies

At KiwiFX Innovations, our trading systems are written in Python with thorough backtesting and ongoing optimization using modern tools.

Consistent Performance with No Emotion

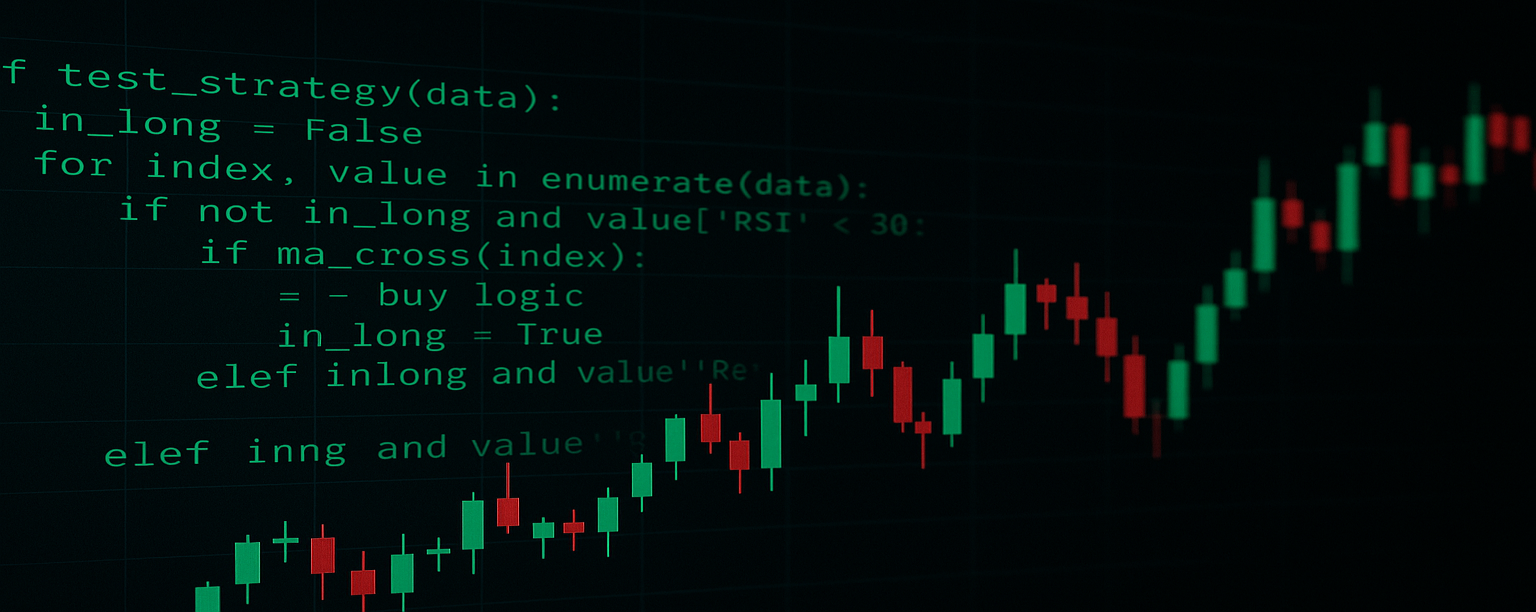

Python-based systems execute trades based on predefined conditions. No emotions, no second-guessing.

Example: If RSI drops below 30 and a moving average crossover occurs, the system enters a long position. It doesn’t matter what the news says or what someone feels—the trade happens as designed.

This consistency leads to more reliable performance and less psychological stress for investors.

Transparency and Control

With platforms like KiwiFX Innovations, clients copy our trades in real-time. There are no hidden signals, no delays, and no guesswork. You see the same entries and exits our algorithms make.

You’re in control, but not in the dark.

Final Thoughts

Emotional trading is a liability in today’s fast-paced markets. By embracing Python-based algorithms, investors can eliminate guesswork and focus on long-term growth.

Ready to leave emotions behind?

Copy our proven trading systems and experience the power of automation with KiwiFX Innovations.